THE RESIDENCY TRAVEL TRACKER

Urgent update July 2024

We would like to apologise to all customers who have experienced tracking issues over the past month. These were unfortunately due to privacy changes implemented by Apple to iOS, that directly affected our access to location and background tracking information. You can find more information on our support page.

Counting days or nights to establish tax residency?

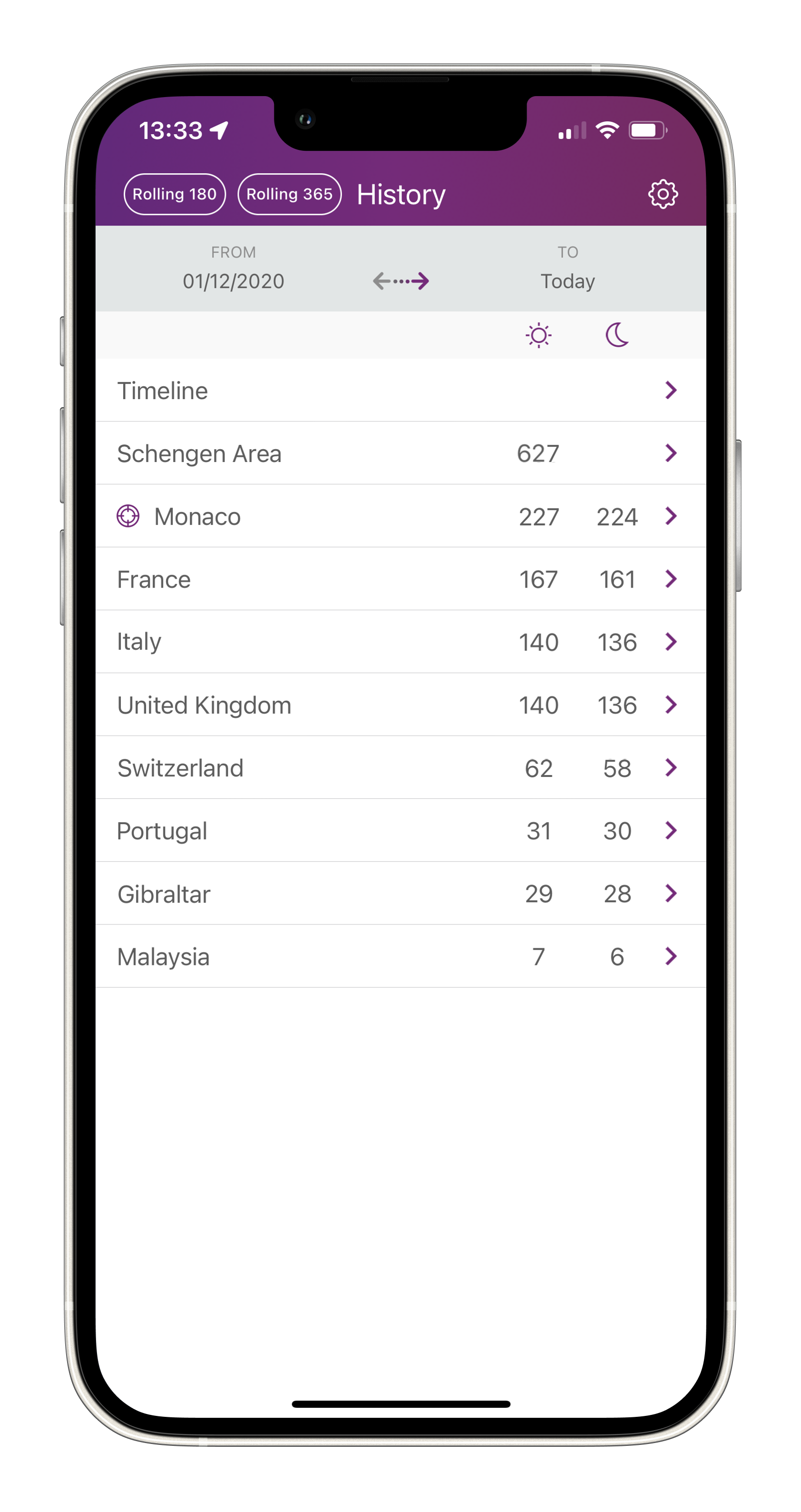

Need to count the days you spend in the Schengen Travel Area?

TrackingDays is the original and trusted residency travel App, keeping track of your days and nights, wherever you are in the world for more than 10 years.

TrackingDays reliably tracks automatically, just leave it running for effortless worldwide day counting!

TrackingDays: The residency travel tracking App

“The App has worked well over a longer period, very reliable… Also very helpful customer service” - App Store Revew

Who uses TrackingDays?

People looking to establish tax residence or non residence buy counting days or nights in a specific country.

People tracking days in the EU Schengen Travel area for the rolling 90 in 180 day rule. TrackingDays counts your rolling Schengen time automatically.

Snowbirds and overseas homeowners, keen not to accidentally become a tax resident of another country.

Small business owners needing to account for the worldwide travel of their employees. TrackingDays offers a cost effective independent alternative to expensive enterprise solutions.

Day counting for residence?

TrackingDays is the perfect tool for individuals counting ‘days’ or ‘nights’ to establish their country of residence. TrackingDays tracks all countries, so whatever your day counting needs, TrackingDays can work for you. A few examples include:

UK "Statutory Residence Test" (SRT) - count nights (your location at midnight).

USA "Substantial Presence Test” - count days. Canadian Snowbirds and Non US Citizens use TrackingDays to avoid accidentally becoming a US tax resident.

Portugal, New Zealand & Malaysia - use the new 'Rolling 365' feature. NZ expats, establish non-resident taxpayer status, via the "325 day rule,”.

Cyprus residence - use TrackingDays for the "60 Day Rule”.

Counting Days in Monaco, Andorra, South Africa, India, Israel, China, or for any country worldwide, TrackingDays can work for you.

Moving to FLorida, Texas or other new US State? Try our sister App "TrackingStates” for US State residence.

EU Schengen Area

Non-EU residents (including UK citizens post Brexit), are limited with the time they can spend in the EU.

Non-EEA nationals can only stay for 90 days in a rolling 180 day period. This could be a single trip or multiple visits totalling 90 days.

TrackingDays can vastly reduce the hassle of keeping track of your Schengen time. With no input required, you can track your Schengen time automaically and reveal your rolling 180 days total with a single touch.

Automatic combined Schengen Area day count.

'Last 180' feature, allowing you to instantly see your rolling 180 day count.

Note: TrackingDays is not a manual Schengen Calculator, it requires no manual input. Just leave the App open and it will count Schengen automatcally.

TrackingDays Schengen count, is for people who don't want the hassle of manaually keeping track.

“TrackingDays gives me ‘at a glance’ peace of mind, that I won’t overstay my Schengen days, even over multiple trips.”

UK Residence Test (SRT)

TrackingDays counts UK nights, a night is your location at midnight.

The UK residence test asks 6 key questions to establish residence. There are three Automatic Overseas tests and three Automatic UK tests. If these tests are not conclusive, the test then considers your connections ('Ties') with the UK.

The Sufficient Ties test counts the number of ties you have with the UK and allocates an allowable number of days in the UK. Ties include:

Family,

Accommodation, UK

Work,

The 90 Day tie and also

Your presence in the UK relative to any other country

US Expats

To become an Expat, US citizens must meet the Physical Presence Test.

“Generally to meet the physical presence test, you must be physically present in a foreign country or countries for at least 330 days during a 12 month period. You can count days you spend abroad for any reason… A Full Day is a period of 24 consecutive hours, beginning at midnight.”

Source: A Guide for U.S.Citizens and Resident Aliens Abroad

TrackingDays includes a Non USA Days feature that tracks full days, midnight to midnight spent outside of the USA.

Snowbirds and Non-USA Citizens

TrackingDays flexibility can help you count your US days for the complicated Substantial Presence Test formula, over a period of 3 years.

Foreigners who own property in the USA or simply enjoy spending their vacation or retirement time in the US also need to keep a close eye on the number of days they spend there.

The IRS uses it’s Substantial Presence Test to calculate if a person is a U.S. resident for Tax Purposes.

To meet the test, you must be in the US for 31 days in the current year and no more than 183 days during the current and two preceding years. But, importantly to arrive at the 183 days figure you must add together:

100% of the days you are present in the current year

1/3 of the days you were present in the previous year and

1/6 of the days you were present two years previous

Trusted in over 60 countries

TrackingDays has been downloaded in over 60 countries worldwide and is trusted to keep track of international movements all over the globe.

China, India, Hong Kong, Ireland, South Africa, Switzerland, Saudi Arabia and many more countries all use ‘day counting’ as a key component in establishing residency.

If you are an Expat residing in one of these countries, or you travel regulalry with visa requirements, you may need to count your days. TrackingDays has been specifically designed for you.